We work with smaller private equity groups, ultra-high-net-worth individuals, and wealthy families to help them source, evaluate, and transition investments. Our team brings expertise in M&A advisory, business valuations, and debt capital raises, supported by deep experience in governance, strategy, legal, finance, and operations.

Our services are designed to preserve and grow family and institutional wealth across generations. Whether the goal is to acquire, divest, or recapitalize a business, we provide tailored solutions that protect reputation, legacy, and employees while unlocking long-term value.

We offer transaction support from end-to-end: fast closings where required, structured partnerships for patient capital, and the creation of tax-efficient vehicles for joint ventures or family investment platforms.

With a network that spans entrepreneurs, family businesses, and capital markets professionals, we provide clients with direct access to opportunities and insights across industries. Our perspective is informed not only by financial expertise, but also by the operational knowledge of families and firms that have successfully built and sustained businesses for over a century.

4 Ways to Buy a Business

- Self-Funded Search – Personal funding, $500K–$10M businesses, 60–100% ownership, role as Owner-Operator.

- Traditional Search – Investor-backed, $10M+ targets, 5–20% ownership, board control, exit in 5–7 years, role as CEO.

- Independent Sponsor – Self-funded with outside investors, $10M+ deals, 5–20% ownership, multiple deals, role as Chairman/President.

- Operating Partner – Investor-sponsored, flexible size, 0–5% ownership, no debt guarantee, role as CEO.

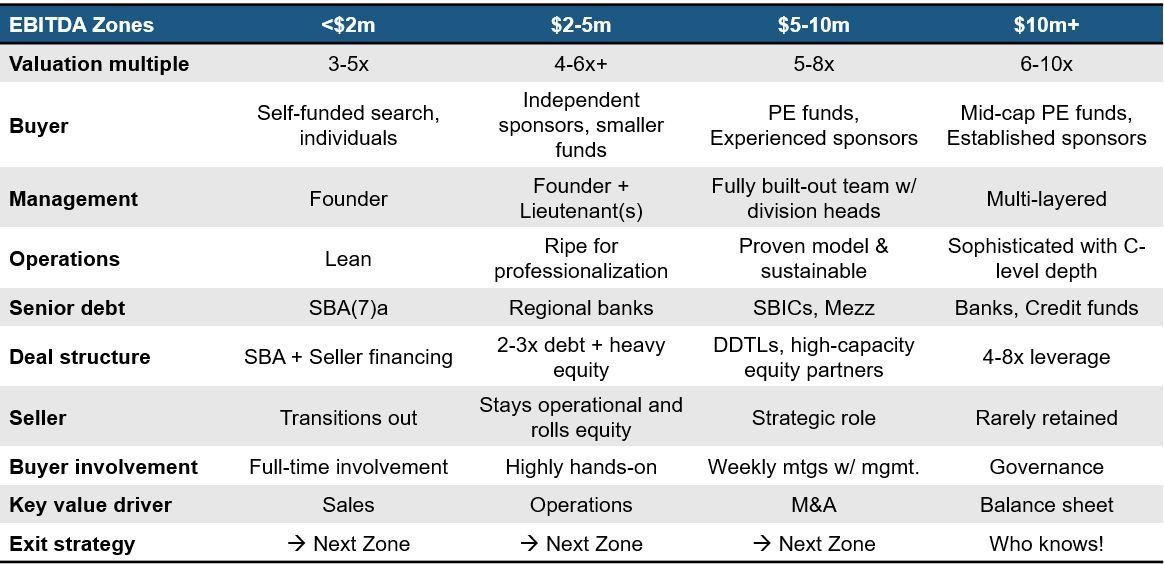

EBITDA Zones – At a Glance

- <$2M – 3–5x multiple, founder-led, SBA + seller financing, seller exits, sales-driven.

- $2–5M – 4–6x+, small funds/independent sponsors, founder + lieutenants, regional bank debt + equity, seller stays involved, ops-driven.

- $5–10M – 5–8x, PE funds, built-out teams, SBICs/mezz financing, seller strategic, M&A-driven.

- $10M+ – 6–10x, established PE funds, multi-layered C-suite, banks/credit funds w/ leverage, seller rarely retained, balance-sheet driven.